Chapter I

The Legal Foundations for Mediation–Arbitration in Financial Disputes

The rapid expansion of China’s financial markets, coupled with ongoing financial innovation and the steady opening of the country’s cross-border financial sector, has markedly increased the complexity and risk of financial transactions. These developments have, in turn, generated an ever-growing number and variety of financial disputes. In recent years, dispute resolution institutions have come to recognize that litigation alone cannot effectively cope with this escalating caseload. Although the establishment of specialized financial courts has promoted professionalization within the judiciary, challenges such as case congestion and difficulties in enforcement remain acute.

Taking Shanghai as a representative example, the Shanghai Financial Court handled 7,310 financial cases in 2024, with a total disputed amount RMB 215.726 billion. The disputes covered a wide range of areas, most notably financial loan contract disputes, securities misrepresentation liability cases, banking and insurance disputes, and issues concerning enforcement of judgments. Financial disputes are distinguished by high amount of subject, intricate transactional structures, and a high degree of specialization among the parties involved. These characteristics expose the limitations of traditional litigation, particularly in terms of efficiency, confidentiality, and procedural flexibility.

展开全文Since the promulgation of the Opinions on Improving the Diversified Mechanism for Dispute Resolution by the General Office of the Communist Party of China Central Committee and the State Council in 2015, China has progressively advanced the top-level design of a diversified dispute resolution system. The financial sector has also been actively advancing the development of non-litigation dispute resolution mechanisms. In practice, a multi-layered dispute resolution framework has emerged, one that integrates mediation, arbitration, and litigation, and that places particular emphasis on the development of the mediation–arbitration combination model (hereinafter the ‘med-arb model’).

The evolution of the Chinese med-arb model exhibits a high degree of policy continuity. As early as 2009, the Supreme People’s Court issued the Opinions on Establishing and Improving the Mechanism for Coordinating Litigation and Non-Litigation Dispute Resolution. This landmark document was the first at the national level to advocate for the coordination, complementarity, and joint development of various dispute resolution mechanisms, and to call for improved institutional linkages among litigation, arbitration, administrative mediation, people’s mediation, commercial mediation, industry mediation, and other non-litigation approaches. Subsequently, the People's Mediation Law of the People's Republic of China (2011) consolidated the legal foundation for mediation by formally recognizing the status of People’s Mediation Committees. Article 33 of this Law provides that ‘where a mediation agreement is reached, either party may apply to a people’s court for judicial confirmation within thirty days; once confirmed by judicial ruling, the agreement may be enforced compulsorily’. This provision established the legal basis for subsequent hybrid models in the financial field, such as ‘mediation plus judicial confirmation’ and ‘mediation plus arbitral confirmation’.

At the local regulatory level, the Shanghai Municipal Bureau of Justice and the Shanghai High People’s Court jointly issued the Opinions on Further Strengthening the Coordination between Litigation and Mediation in 2019, which introduced institutional arrangements to optimize the interface between mediation and litigation in commercial disputes. In 2021, Shanghai implemented the Regulations on Promoting Diversified Resolution of Conflicts and Disputes in Shanghai, which devotes Chapter II specifically to mediation. Among this Regulation, Article 27 explicitly provides for the procedural linkage between mediation and arbitration, while Article 53(2) addresses the interface between mediation and notarization. Compared with seeking judicial remedies or court confirmation after mediation, arbitral and notarial confirmation offers distinct advantages, including shorter review periods and greater enforceability in the international arena.

Since 2020, leading arbitral institutions such as the Beijing Arbitration Commission (BAC) and the Shenzhen Court of International Arbitration (SCIA) have successively established med-arb coordination mechanisms. For instance, Articles 43 and 44 of the BAC Arbitration Rules (2022) respectively govern ‘Mediation by the Tribunal’ and ‘Independent Mediation’, both stipulating that ‘where a settlement agreement is reached through mediation, the arbitral tribunal may, at the parties’ request, issue a Statement of Mediation or render an award in accordance with the terms of the settlement agreement’. Similarly, Chapter VII of the SCIA Arbitration Rules (2025) introduces a more flexible hybrid med-arb procedure, authorizing arbitrators to conduct mediation during arbitration proceedings and, upon the parties’ consent, to issue a mediation statement with the same effect as an arbitral award. Together, these pioneering institutional arrangements by leading arbitral bodies have consolidated the doctrinal logic that mediation outcomes may be transformed into arbitral awards, thereby providing concrete legal infrastructure for the integration of mediation and arbitration.

Shanghai, in particular, has remained at the forefront of experimental practices concerning the med-arb model in financial cases. In June 2018, the Financial Ombudsman Service Shanghai (FOSS) and the Financial Arbitration Court in Shanghai Arbitration Commission (SHAC) jointly signed the Cooperation Agreement on Establishing a Mechanism for Coordinating Financial Dispute Mediation and Arbitration, proposing an institutional model characterized by ‘mediation first, arbitral confirmation thereafter’. In 2024, the Minhang District People’s Court of Shanghai, established an Integrated Commercial Dispute Resolution Platform, which aims to leverage the expertise of arbitral institutions and commercial mediation centers, promote coordination between mediation and arbitration, and build a multi-tiered system linking mediation, arbitration, and litigation. Most recently, in 2025, Shanghai Eastern International Commercial Mediation Center (SICMC) and the SHAC jointly issued and implemented the Guidelines on the Coordination between Mediation and Arbitration, under which the first case successfully resolved a commercial loan contract dispute exceeding RMB 5 million. This case vividly demonstrates the significant advantages of the ‘commercial mediation plus arbitral confirmation’ model in enhancing the efficiency and finality of commercial dispute resolution.

From nationwide institutional design to localized experimentation, China’s financial dispute resolution system is undergoing a fundamental transformation, from a court-centered, single-track model toward a multi-tiered structure characterized by the coordination of commercial mediation, arbitration, and litigation. The emergence of the med-arb model represents not only a pragmatic response of the legal system to the demands of the financial market, but also a conceptual shift in China’s rule-of-law philosophy, from ex post adjudication to ex ante governance. The wider application of the med-arb model in the financial cases holds multifaceted significance. It can alleviate the judicial burdens created by the proliferation of financial disputes, enhance the efficiency and effectiveness of protecting the legitimate economic interests of financial actors, and contribute to China’s engagement in global financial governance. Moreover, it has also provided valuable practical experience for China's participation in global financial governance and the formulation of international arbitration and mediation rules.

Chapter II

The Institutional Advantages of the Med-Arb Mechanism in Financial Disputes

Commercial mediation and arbitration embody two distinct philosophies of dispute resolution. The former emphasizes autonomy, negotiation, and consensual agreement, whereas the latter rests upon authority, adjudication, and enforceability. In the field of financial dispute resolution, the integration of these two mechanisms represents not merely a procedural innovation but also a juridical response to the imperatives of market rationality and economic efficiency.

Compared with litigation or arbitration as stand-alone processes, the med-arb model achieves a dual objective of procedural economy and certainty of outcome. It reduces the aggregate cost borne by the parties in resolving disputes while simultaneously enabling them to reach mutually acceptable outcomes through a contractual and cooperative framework. Moreover, by facilitating consensual settlement under institutional supervision, the med-arb model contributes to the restoration of social relations and commercial credit, thereby generating broader systemic benefits for the financial market.

Drawing upon the author’s professional experience and casework involving the med-arb model in the financial disputes, it may be argued that this integrated model offers at least four institutional advantages: Autonomy and Flexibility, Efficiency and Cost-Effectiveness, Enforceability and Legal Certainty, and Normative Integration and Systemic Coherence.

I. Autonomy and Flexibility

As its name suggests, the med-arb model means the integration of mediation and arbitration, which combining two dispute resolution mechanisms that both rest on the principle of party autonomy. At the core of this model lies the notion of voluntary participation and consensual procedure design. The initiation of proceedings is not imposed by any mediation or arbitration institution but rather based on contractual stipulation or subsequent agreement between the parties. In practice, financial institutions, investors, and corporate entities may include in their contracts multi-tier dispute resolution clauses, specifying that ‘any dispute arising from this contract shall first be submitted to a designated mediation institution for mediation; if mediation fails, the dispute shall then be submitted to arbitration’. Such layered dispute resolution provisions have become ubiquitous in international commercial contracting, reflecting a shared commitment to procedural flexibility and private ordering.

Unlike judicial litigation, the med-arb model fully respects the parties’ autonomy in determining procedural pathways. Parties are free to choose the commercial mediation institution, arbitral institution, mediators, and arbitrators. For instance, the SHAC allows parties to select their own mediation experts and provides two alternative mediation tracks: (1) mediation administered by the arbitral tribunal or the SHAC’s Center for Diversified Dispute Resolution; or (2) mediation conducted by an external institution, in which case the arbitral tribunal may subsequently render an award based on the mediated settlement. This party-driven selection mechanism ensures a high degree of professional specialization and procedural adaptability, allowing dispute resolution design to be closely tailored to the substantive and structural features of each financial dispute. Flexibility in financial mediation is also reflected in the rules of evidence and fact-finding. Mediators may draw on industry expertise and practical experience in evaluating facts, rather than adhering rigidly to statutory evidentiary rules, thereby improving the efficiency and pragmatism of negotiations.

According to the Mediation Rules of the SICMC, mediation in financial cases may be conducted either offline or online, and parties may request that sessions be held at locations other than the mediation center, such as the business premises of one of the parties. This arrangement grants parties the widest possible spatial and procedural flexibility in conducting mediation. Moreover, in cases involving multiple disputed issues, parties may agree to partial mediation, temporarily setting aside contentious matters while reaching consensus on non-contentious or preliminary issues. For example, in certain financial disputes, the parties may first mediate and confirm matters relating to the right to information, and subsequently advance the resolution of remaining issues based on that confirmed understanding.

For instance, within the renowned U.S. the med-arb model established by JAMS, the organization has published a Clause Drafting Guide recommending that parties expressly stipulate the sequential dispute resolution procedures within their contractual text. A model clause might read that If the parties are unable to resolve a dispute through negotiation, the matter shall first be submitted to mediation administered by [a designated institution]; if mediation fails, the dispute shall then be referred to binding arbitration. Such provisions fully respect the parties’ autonomy in selecting the time, venue, participants, and procedural arrangements, while also permitting them to specify a mediation time limit (for example, 30 or 45 days) to prevent deliberate procedural delay. Clauses of this nature are particularly prevalent in U.S. financial service contracts, investment and financing agreements, and insurance disputes.

In the Chinese context, the principle of party autonomy is not inherently incompatible with regulatory guidance. Financial regulators have already begun to encourage a mediation-first approach. The Opinions on Comprehensively Promoting the Diversified Resolution Mechanisms for Financial Disputes, jointly issued by the supreme judicial authority, national financial regulatory authorities, explicitly emphasize the policy of ‘mediation first, coordination between mediation and adjudication’. Building on this foundation, it would be prudent to recommend that parties incorporate similar clauses into their commercial contracts, clearly establishing a ‘mediation-first, mediation–arbitration combined’ mechanism for dispute resolution. Such contractual arrangements enhance the ex-ante predictability of dispute management, provide parties with a tailored pathway for conflict resolution, and simultaneously satisfy their demand for an efficient and cost-effective process.

II. Efficiency and Cost-Effectiveness

The most salient advantage of the med-arb model lies in its ability to streamline procedural design, thereby reducing both the temporal and financial costs of dispute resolution.

From the perspective of time efficiency, traditional financial litigation typically proceeds through multiple stages like filing, acceptance, trial, and enforcement, often extending over several months or even years. To optimize this issue, Wu’an Primary People's Court Hebei has established seven specialized divisions for financial judicial cases, encompassing case filing, mediation, preservation, and enforcement. This institutional arrangement ensures seamless coordination among procedural stages. In the first quarter of 2025 alone, the court handled 154 financial cases, of which 129 were resolved through preliminary mediation. As a result, the average adjudication period for financial cases was reduced to just 15 days. In the arbitration context, leading arbitral institutions in China generally set the threshold for convening a three-member tribunal at around RMB 5 million. In financial loan disputes where facts are relatively straightforward but the amount in controversy is substantial, the process of constituting the tribunal, through co-appointment, recommendation, or selection, can take one to two months, consuming considerable time and administrative resources from arbitral secretariats. By contrast, the pre-arbitration mediation phase, which typically concludes within 30 days, enables the parties to reach partial or even full settlements in a significantly shorter period. This not only alleviates the caseload of arbitral tribunals but also markedly reduces the overall expenditure that would otherwise be incurred in full-fledged litigation or arbitration proceedings.

From the perspective of economic cost, the med-arb model demonstrates equally significant advantages. In the financial sector, parties engaging in mediation are typically required to pay both a case registration fee and a mediation fee. The registration fee generally ranges from RMB 500 to RMB 1,000, while the mediation fee is charged based on the amount in dispute or the mediator’s working hours, both substantially lower than the costs associated with litigation or arbitration. Where mediation transitions into arbitration, arbitral institutions often grant fee reductions, either by halving the arbitration fee or waiving a portion thereof, thus further alleviating the financial burden on the parties. A notable example can be found in the BAC, which issued its Rules on Expedited Mediation-Arbitration Procedures on April 15, 2025. In the first case administered under these rules, the entire process from case registration to award issuance was completed within seven days, with the total arbitration fee amounting to merely 35% of the regular fee for comparable cases, and approximately 26.22% of the total cost of two-instance court litigation involving the same amount in controversy. This procedural innovation markedly reduces the overall cost of rights protection for parties involved in financial disputes. Similarly, the Guidelines on the Coordination between Mediation and Arbitration between the SICMC and the SHAC specify that cases resolved under the coordination mechanism are subject to special fee schedules, whereby mediation and arbitration fees are calculated separately and preferentially.

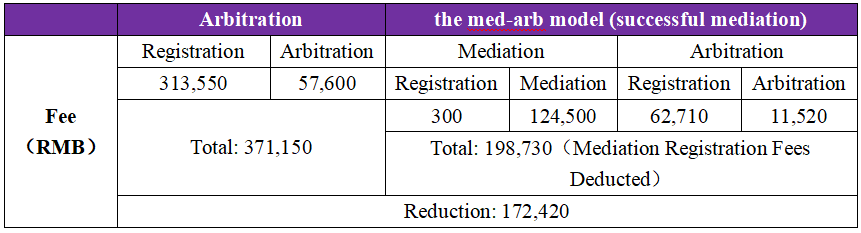

Compared with traditional dispute resolution avenues, the higher the amount in dispute, the greater the economic savings achieved through the med-arb model. For instance, in a financial dispute involving RMB 60 million, applying the SICMC Fee Schedule in conjunction with the SHAC Rules yields the following comparison of total procedural costs between standalone arbitration and the mediation–arbitration combined approach (see Table 1 below).

It can be observed that, in the case at hand, the total cost under the med-arb model amounted to RMB 198,730, whereas the cost of proceeding solely through arbitration reached RMB 371,150. This demonstrates a cost reduction of RMB 172,420, effectively cutting the overall expenditure by nearly half. Such savings are particularly significant in the financial sector, where high-stakes disputes often entail complex factual and legal issues requiring extensive procedural resources.

From a comparative law perspective, the cost-efficiency and temporal advantages of the Arb–Med–Arb Protocol jointly established by the Singapore International Mediation Centre (SIMC) and the Singapore International Arbitration Centre (SIAC) are especially noteworthy. Under this model, mediation is institutionally embedded within the arbitration process, allowing the two procedures to operate in a seamlessly integrated and complementary manner. The AMA Protocol provides a predefined procedural timeline and cost structure, preventing unnecessary procedural delays and ensuring predictability in dispute resolution expenses, which embodies the principles of economic rationality in cross-border financial dispute resolution.

III. Enforceability

The widespread adoption of the med-arb model lies fundamentally in its ability to translate negotiated settlements into legally enforceable instruments through the arbitral process. This mechanism ensures that outcomes achieved through consensual negotiation are not merely symbolic but can be legally executed with binding force. At the same time, it provides a confidential arbitral fallback in the event that mediation fails, thereby maintaining both procedural efficiency and confidentiality throughout the dispute resolution process.

Under China’s legal framework, a mediated settlement may be converted into an enforceable legal document through three principal avenues: arbitral confirmation, notarization, and judicial confirmation. Pursuant to Article 64(2) of the Arbitration Law of China, ‘Where a settlement is reached through mediation, the arbitral tribunal shall prepare a mediation statement or an award based on the result of the agreement. The mediation statement and the award shall have the same legal effect’. Furthermore, China’s accession in 1987 to the United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Awards (the New York Convention) ensures that arbitral awards rendered by Chinese arbitration institutions can be recognized and enforced in over 172 jurisdictions worldwide. Consequently, the med-arb model in financial dispute resolution not only facilitates the effective domestic enforcement of settlements but also strengthens cross-border enforceability, a crucial factor in the context of global financial transactions. By doing so, it protects the substantive interests of Chinese financial actors and enhances China’s attractiveness as a preferred jurisdiction for resolving international financial disputes, thereby elevating the international standing of China’s financial dispute resolution system.

For instance, in 2023, a case handled by the FOSS, both parties reached a settlement through mediation and signed a settlement agreement. Through the mediation–arbitration interface mechanism, the mediation center submitted the agreement to the SHAC, which promptly issued an arbitral award conferring enforceability upon the mediated result. This process ensured the seamless implementation of the mediated settlement and illustrated the institutional effectiveness of the med-arb model in achieving both efficiency and enforceability.

In the realm of international law, the Convention on International Settlement Agreements Resulting from Mediation (the Singapore Convention on Mediation) represents a significant milestone in establishing a uniform framework for the recognition and enforcement of international mediated settlement agreements. China has already announced its intention to accede to the Convention, although the domestic ratification procedures have not yet been completed. Article 3 of the Convention stipulates that ‘If a dispute arises concerning a matter that a party claims was already resolved by a settlement agreement, a Party to the Convention shall allow the party to invoke the settlement agreement in accordance with its rules of procedure and under the conditions laid down in this Convention, in order to prove that the matter has already been resolved’. This provision underscores the growing international recognition of mediation as a legitimate and enforceable means of dispute resolution, extending its authority beyond purely consensual arrangements to a status comparable to arbitral and judicial decisions in terms of legal effect. Moreover, the Arb–Med–Arb Protocol, jointly established by the SIMC and the SIAC, provides an institutional pathway for transforming a successful mediated settlement into a consent arbitral award. Such an award is directly enforceable under the New York Convention, thereby ensuring its global enforceability across all Convention member states.

IV. Institutional Integration and Normative Coherence

Another significant value of the med-arb model lies in its capacity to promote institutional integration within the multi-track dispute resolution system. Historically, mediation, arbitration, and litigation functioned as distinct and largely uncoordinated mechanisms, lacking efficient procedural interconnectivity. The emergence of the med-arb model has bridged this institutional divide by fostering procedural alignment and rule harmonization among these mechanisms, forming a continuous chain of ‘front-mediation, mid-arbitration, and back-enforcement’.

The med-arb model has proven instrumental in driving arbitral institutions to revise their procedural rules or establish dedicated mediation frameworks, thereby incorporating mediation as a formal and integral component of dispute resolution. For example, Articles 54 and 55 of the 2024 Arbitration Rules of the Shanghai International Arbitration Center (SHIAC) provide explicit provisions concerning the initiation, conduct, and confirmation of mediation proceedings. Notably, Article 55(3) stipulates that arbitration proceedings shall automatically terminate if mediation fails, ensuring both procedural continuity and the enforceability of outcomes, enhancing predictability among disputing parties.

The med-arb model also encourages closer institutional cooperation among diverse dispute resolution bodies. Taking Shanghai as an example, since the establishment of the SICMC on 18 April 2025, it has rapidly established a collaborative relationship with the SHAC. Within two months, the two institutions jointly issued the Guidelines on the Coordination between Mediation and Arbitration, creating a cross-institutional case-transfer mechanism that enables seamless procedural transition and accelerates the pace and depth of dispute resolution.

In sum, the med-arb model embodies a combination of autonomy and flexibility, efficiency and cost-effectiveness, enforceability and institutional integration and normative coherence. At its core, the model achieves a balance between consensual negotiation and authoritative adjudication, as well as between procedural efficiency and substantive fairness. Such a design corresponds to the high-speed and high-trust requirements of modern financial transactions, while reflecting China’s progressive absorption and localization of pluralistic dispute resolution principles in its ongoing process of building a rule-of-law state. Accordingly, the med-arb model should be regarded as a crucial pillar in the construction of a high-quality financial rule-of-law framework in China. It represents not only an innovation beyond litigation-centrism, but also a systemic response to the global trend toward integrated and diversified dispute resolution mechanisms. Empirical experience from leading jurisdictions such as Beijing and Shanghai demonstrates that, under a robust legal infrastructure and efficient institutional collaboration, the med-arb model can genuinely fulfill its promise of speed, precision, and stability, thereby providing sustainable institutional support for the advancement of financial governance and the modernization of China’s legal system.

Chapter III

Application Fields of the Med–Arb Model in Financial Disputes

While the med-arb model possesses notable institutional advantages, it is not universally applicable to all forms of disputes. Its suitability depends upon several key factors like the complexity of the dispute, the sustainability of the parties’ relationship, and the degree of negotiability inherent in the conflict. In the financial sector, disputes typically share three defining characteristics: a strong contractual foundation, a high level of technical specialization, and pressing time sensitivity. The med-arb model aligns closely with these features and offers unique procedural advantages in addressing them. First, the strong contractual nature of financial disputes implies that most disagreements arise from well-documented written agreements containing standardized dispute resolution clauses. This contractual basis enables the prior incorporation of the med-arb provisions, ensuring predictability and enforceability at the onset of transactions. Second, the high degree of technical specialization inherent in financial activities requires adjudicators with profound sectoral expertise. The med-arb model accommodates this demand by allowing the selection of mediators and arbitrators who possess not only legal acumen but also in-depth knowledge of financial instruments and market practices. Third, the urgency of time in financial markets necessitates swift, final, and enforceable dispute resolution, to avoid rapidly financial risks.

Drawing from both practical experience and empirical developments in China’s financial dispute resolution system, the author identifies three major categories of financial disputes in which the med-arb model demonstrates particular utility: (1) Financial loan contract disputes, (2) Financial product investment disputes, and (3) Cross-border financial disputes.

I. Financial Loan Contract Disputes

Financial loan contract disputes are among the most prevalent forms of conflicts in the banking, trust, and financial leasing sectors. The contentious issues in such cases typically revolve around loan performance, guarantee liability, interest calculation, and default responsibility. Given that contractual provisions in these cases are generally explicit and the relevant facts relatively straightforward, parties tend to prioritize the efficiency and enforceability of outcomes over factual contestation.

These characteristics render the med-arb model highly suitable for resolving such disputes. During the mediation phase, parties can engage in flexible negotiations conducive to a debt-restructuring-style settlement. Where partial performance has occurred or disputes over guarantees exist, the mediator may help design tailored arrangements, such as installment repayment plans or collateral disposal mechanisms, based on the debtor’s solvency and commercial realities. If mediation succeeds, the settlement agreement can be confirmed through arbitration, thereby conferring immediate enforceability and ensuring realization of creditor rights. If mediation fails, the case transitions seamlessly into arbitration without the need to refile submissions or resubmit evidence, thus significantly reducing procedural costs and duplication of effort.

A representative example occurred in September 2025, when the Shenzhen Qianhai International Commercial Mediation Center (SQICMC) and the Shenzhen Court of International Arbitration (SCIA) jointly resolved a financial loan contract dispute between a state-owned bank and a Shenzhen-based enterprise, involving a disputed amount of nearly RMB 30 million. Upon acceptance, the mediation center promptly identified the case’s financial nature and appointed a mediator with extensive experience in banking and finance disputes. Employing a combination of back-to-back and face-to-face mediation techniques, the mediator conducted parallel communications with both parties. On one hand, the mediator explained to the bank the debtor’s operational difficulties and genuine intent to repay, emphasizing the practical challenges of enforcement if overly aggressive collection measures were pursued. On the other hand, the mediator reminded the enterprise of the legal consequences of delinquency and the bank’s fulfillment of compliance obligations during loan issuance, thereby encouraging it to face its repayment responsibilities constructively. After multiple rounds of patient negotiation, both parties accepted a balanced settlement proposal that safeguarded the bank’s creditor rights while preserving the debtor’s operational continuity, and formally executed a Mediation Agreement. Subsequently, the SCIA accepted the parties’ application for arbitral confirmation, swiftly constituted an arbitral tribunal, and meticulously reviewed the evidentiary record. The tribunal conducted targeted inquiries, verified the legality of the settlement’s content and the authenticity of mutual consent, and thereafter issued an arbitral consent award based on the mediation agreement, thereby granting the settlement binding and enforceable legal effect.

In the context of batch financial loan cases, the med-arb model further demonstrates its efficiency and cost-effectiveness. Taking batch financial loan cases arising from bank consumer loans as an example, each ranging between RMB 200,000 and 500,000, respondents often failed to repay due to temporary liquidity shortages. Directly initiating arbitration in such cases could result in costs exceeding the amount of accrued interest, further diminishing repayment willingness. By introducing the med-arb model, communication and settlement can occur at substantially lower enforcement costs, thereby improving recovery rates. Even where a respondent refuses mediation, the Article 7 of the SICMC provide that a respondent must confirm within five days of receiving notice whether it agrees to mediate; if it explicitly refuses or fails to respond within the prescribed period, the mediation phase automatically terminates, and the case proceeds directly to arbitration without imposing additional time burdens on the claimant.

Essentially, financial loan contract disputes center on the realization of creditor rights. The med-arb model enables parties to transition flexibly between consensual resolution and enforceable adjudication, achieving a dynamic balance between procedural economy and credit rehabilitation. It not only safeguards the legitimate interests of financial institutions, but also provides financially distressed enterprises with valuable time and space for operational recovery. Thus, the model simultaneously fulfills the objectives of commercial dispute de-escalation, protection of banking interests, and facilitation of enterprise sustainability, reflecting both economic rationality and social functionality within modern financial governance.

II. Financial Product Investment Disputes

Compared with loan contract disputes, financial product investment disputes center on innovative financial instruments characterized by structural complexity and risk diversification. These include wealth management products, securities investment funds, structured notes, and various derivatives. Such disputes often involve multiple intertwined legal relationships, controversies over disclosure compliance, and a wide diversity of investor identities. Traditional dispute resolution mechanisms due to their procedural rigidity, weak coordination between civil and criminal proceedings, and strict evidentiary requirements, are often ill-suited to address the practical needs of investors seeking relief in private fund disputes.

In one case handled by the author, an investor initiated arbitration proceedings over a private equity fund contract. During the arbitration, both the fund manager and its controlling shareholder were criminally investigated and later convicted of illegal fundraising. Under these circumstances, the arbitral tribunal required the investor to withdraw the arbitration claim, otherwise it would dismiss all requests. Even more discouragingly, regardless of whether the investor withdrew the claim or faced dismissal, the pre-paid arbitration fees would not be refunded. This outcome, where the investor received no substantive remedy but incurred additional costs, resulted in double losses. Such a scenario severely undermines the willingness of investors in similar private fund disputes to pursue legitimate remedies, as some may abandon claims altogether out of fear of excessive cost. Moreover, in China’s current private equity market, the underlying assets of funds are often registered in the name of fund managers, creating ambiguous ownership and unclear property attribution. If property preservation measures are imposed during arbitration, the underlying assets may be frozen, thereby impeding their liquidity and marketability. This not only fails to help investors realize their claims but may also accelerate risk exposure in financial products, heightening systemic tensions among stakeholders.

On September 17, 2025, the China (Beijing) Securities and Futures Arbitration Center, in collaboration with the BAC, announced the implementation of the Securities and Futures Arbitration Rules, effective from November 1, 2025. These rules explicitly introduce the med-arb model into the resolution of financial product disputes and emphasize the ‘parallel mechanism of mediation and expert support’. Article 6 of the Rules establishes a pre-mediation mechanism, allowing cases to be initially referred to mediation upon acceptance; if mediation fails, the case seamlessly transitions to arbitration. Articles 11, 13, and 15 introduce an ‘expert support mechanism’, under which industry specialists may be invited to offer professional opinions, conduct expert mediation, or provide dispute assessments. This ensures authoritative evaluation of technical issues and enhances the credibility and acceptance of arbitral outcomes.

Under this framework, the med-arb model offers a novel and adaptive path for resolving financial product investment disputes. Through the flexible mediation stage, external experts can intervene early to propose viable solutions, identify key issues, and recommend preservation or arbitration measures in a timely manner. This approach enables the clarification of asset ownership and the revitalization of underlying assets within a non-litigation framework, reducing silent costs and preventing further risk diffusion. Ultimately, it strengthens the protection of investors’ lawful rights and interests, mitigates financial instability, and fosters a well-regulated, transparent, and harmonious financial product market ecosystem.

III. Cross-Border Financial Disputes

In cross-border financial transactions, contracting parties often belong to different jurisdictions, which frequently gives rise to multiple challenges, including conflicts of law, jurisdictional disputes, and cross-border asset management. Traditional litigation may be delayed due to issues such as forum shopping or parallel proceedings, and even a favorable judgment may be difficult to enforce internationally, resulting in the so-called ‘winning the case but unable to collect’ dilemma. In contrast, the med-arb model leverages the international enforceability of arbitral awards under the New York Convention to overcome these challenges. Currently, the New York Convention has been adopted in over 170 countries and regions, and its principle of non-substantive review significantly lowers the threshold for cross-border enforcement of arbitral awards.

The med-arb model provides both procedural compatibility and international enforceability in cross-border financial disputes. The flexibility of the mediation phase helps mitigate cultural and institutional frictions, while the arbitration phase ensures enforceable outcomes under international law. In cross-border economic disputes, litigation timelines are often unpredictable; however, mediation allows parties to engage in negotiation, consultation, and advisory services that facilitate cross-cultural communication and help evaluate case prospects. This encourages commercial settlements, strengthens foundations for continued cooperation, and promotes mutually beneficial outcomes. If mediation succeeds, the resulting agreement can be confirmed through arbitration, producing an enforceable award that is recognized internationally, thereby significantly enhancing the global effectiveness of dispute resolution. This feature is of practical significance for Chinese financial institutions going global as well as foreign financial institutions entering China.

Moreover, cross-border financial disputes frequently involve complex issues such as foreign law determination and interpretation of clauses. During arbitration, parties may retain expert witnesses to testify or provide reports to support their claims. Under the med-arb model, certain mediation institutions have gradually incorporated multi-tiered dispute resolution support services as an alternative to expert witnesses at the arbitration stage. For example, Article 17 of the SICMC Mediation Rules provides that, upon joint request by the parties or proposal by the mediator with unanimous consent, a professional working committee may be engaged to provide legal consultation or issue a legal determination report on a specific legal issue. Such consultation and reports can serve as mediation materials, offering neutral analyses of the applicable law to all parties and thereby enhancing the likelihood of a successful mediation outcome.

It is also noteworthy that recent developments in international mediation provide additional reinforcement for the med-arb model. In 2019, China signed the Singapore Convention on Mediation, which departs from the traditional contractual nature of settlement agreements and grants cross-border enforceability to international settlement agreements issued by independent mediation institutions. While this creates a potential conflict with domestic law requirements regarding the legal effect of mediation agreements issued by local mediation institutions, the Convention nonetheless complements the med-arb model. After its ratification and implementation in China, simple cross-border financial disputes can be directly enforced under the Convention, while more complex disputes can rely on the med-arb model as a fail-safe mechanism, further enhancing China’s multi-tiered dispute resolution system for cross-border financial matters.

Chapter IV

Multi-Tiered Clause Design for Mediation–Arbitration in Financial Disputes

Based on the foregoing analysis, it is advisable for investors, creditors, financial institutions, and other financial parties to expressly incorporate multi-tiered dispute resolution clauses in their financial contracts, explicitly specifying the med-arb model as the default mechanism. For example:

1. Any dispute arising out of or in connection with this contract, the parties shall first submit the dispute to Shanghai Eastern International Commercial Mediation Center (SICMC) for mediation in accordance with the Mediation Rules of SICMC for the time being in force.

2. Where any settlement reached during the mediation and the parties need an enforceable instrument pursuant to the conciliation agreement, the parties shall submit to Shanghai Arbitration Commission (SHAC) for an arbitration award or a conciliation statement.

3. Where no settlement reached during the mediation, the parties shall submit the dispute to SHAC for arbitration in accordance with the Arbitration Rules of SHAC.

In practice, some parties directly submit their disputes to litigation or arbitration, attempting to bypass the multi-tiered dispute resolution clauses, which may lead to challenges against the final award under judicial review. Given the arbitration institutions' respect for party autonomy, the current backlog of cases in courts, and China’s strong advocacy for the development of diversified dispute resolution mechanisms, courts and arbitration institutions generally hold that if a financial contract clearly stipulates an effective multi-tiered Med-Arb dispute resolution clause, the dispute should proceed according to that clause, and therefore, litigation or arbitration may not be accepted. Article 13 of the Guidelines on the Coordination between Mediation and Arbitration between SICMC and SHAC expressly codifies this principle that ‘Where parties have agreed to mediation-arbitration multi-tiered dispute resolution clauses, disputes shall first be submitted to SICMC for mediation in accordance with the applicable mediation rules. SAC shall not accept cases that have not undergone prior mediation’.

In summary, the med-arb model offers significant advantages in addressing and resolving financial disputes. With China’s ratification of the Singapore Convention on Mediation, the domestic institutional framework for Med-Arb is expected to continue improving, and leading arbitration institutions have already issued corresponding guidance documents. These developments collectively pave the way for the long-term application and evolution of the med-arb model in the resolution of financial disputes.

特别声明:

大成律师事务所严格遵守对客户的信息保护义务,本篇所涉客户项目内容均取自公开信息或取得客户同意。全文内容、观点仅供参考,不代表大成律师事务所任何立场,亦不应当被视为出具任何形式的法律意见或建议。如需转载或引用该文章的任何内容,请私信沟通授权事宜,并于转载时在文章开头处注明来源。未经授权,不得转载或使用该等文章中的任何内容。

— 往期推荐 —

1. 罗里达等:商事仲裁中程序令的实践运用

2. 罗里达等:Practical Use of Procedural Orders in Arbitration

3. 罗里达等:《取消外国公文书认证要求的公约》对英属离岸地扩展适用的法律分析

4. 罗里达等:Analysis on Hague Convention to BOTs

5. 罗里达等:金融案件调仲结合的理论与实务探析

本文作者

实习生陈星宇对本文亦有贡献

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)